Should First-time Home Buyers Get a 30 Year or a 15 Year Mortgage?

January 14, 2016 –

The short answer: the 15 year mortgage is better in terms of the borrower saving money.

The long answer: First time home buyers, on average, stay in their home for 11 years, according to a report by Realtor.com in October 2015. In 2013, I recall that this statistic was 8 years.

Point #1 – When deciding what kind of mortgage to get, I should also be thinking about the next home I purchase. So when it’s 11 years into the future (and remember, time flies!) and I’m selling the first home and preparing to buy the next home, I’ll be in a better position with more money in my pocket. The question is exactly how much more money will I have as a result of getting a 15 year mortgage on the first home?

Let’s look at an example and compare a 30 year mortgage with a 15 year mortgage:

Using the Loanreader ‘Purchase’ calculator, let’s see how the total cost of these mortgages plays out over the next 11 years. This example assumes I’m in the 20% tax bracket which effects the interest deduction on my federal tax return each year.

What we find here is that the total cost of the 15 year mortgage is quite a bit less than the total cost of the 30 year mortgage …. $32,733 less. In other words, I will literally be $32,733 wealthier with the 15 year mortgage at the 11 year time point (this takes into account the interest paid, principal paid (equity gained), and deductions on federal taxes).

Although the monthly payment of the 30 year mortgage ($1,432) is lower than the 15 year mortgage ($2,130), and the difference is $698, the more important thing to note is the amount of interest and principal being paid to the lender at each payment. For example, here are the numbers for the first two payments:

The 15 year schedule requires me to pay less interest at each payment (e.g., $850 versus $1,000 at the 1st payment), as well as more principal at each payment…. MUCH more principal! For example, $1,279.95 versus $432.25 on the 1st payment – and the amount of principal to pay increases at each payment. This is why the 15 year mortgage is superior to the 30 year mortgage. With the 15 year mortgage, I will pay much less interest as well as gain equity in the home much faster.

So the point is that I will have $32,733 more in my pocket with the 15 year mortgage (at the 11 year time point) and I can use this money however I want to, including putting it towards the down payment on the second home. As you may know, having a good down payment such as 20 to 40% has benefits such as avoiding private mortgage insurance (PMI) and obtaining a lower interest rate from lenders.

Next, let’s modify our example and go forward in time by one year where we will assume interest rates are 1% higher (in the calculator, enter 5% for the 30-year mortgage and 4.4% for the 15-year mortgage). The savings with the 15 year mortgage, in this case, would be even greater! $38,585.

A critic’s response: Someone may say, “Wait a minute; the monthly payment for the 15 year mortgage is quite a bit higher than the 30 year mortgage. I think it’s better to get the 30 year mortgage with the lower monthly payment, and then I can make extra payments and save the money this way.” And the person will explain that they have flexibility with paying the extra payments, in case they get into financial trouble. Making extra payments towards the principal always saves money, but still it cannot achieve what the 15 year mortgage achieves. Let’s consider this argument by putting in the numbers.

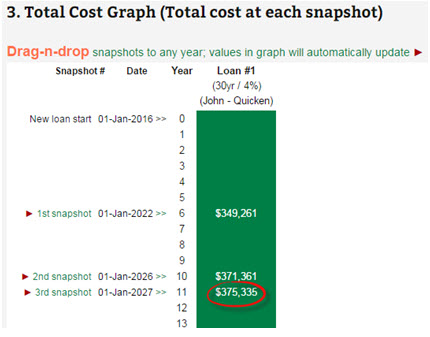

Point #2 – Always measure total cost when comparing mortgage scenarios. This requires some real critical thinking as we evaluate this. Using our example above, if I get a 30 year mortgage and make an extra payment of $698 every single month without fail (by paying $698 extra each month, the monthly payment will then equal the monthly payment for the 15 year mortgage – approximately $2,130), then after 11 years the total cost for this scenario is $375,335, as shown below. (note: I’m still using the Purchase calculator, but looking at just mortgage #1).

Next, I can compare this total cost of $375,335 with the total cost of the straight 15 year mortgage at the 11 year time point ($361,293 as shown in the Total Cost Graph shown earlier), and the difference is $14,042. So what this means is that the 30 year mortgage with extra payments of $698 being paid monthly does save money, but it still costs $14,042 more than the straight 15 year mortgage (at the 11 year time point). It’s interesting to think about.

One other interesting point in this example is that the 30 year mortgage with extra payments shortens the mortgage to approximately 15 years. So at first glance, someone may argue that the 30 year mortgage with extra payment approach equals or rivals the straight 15 year mortgage, but that is not true. It equals it only in terms of the length of time (i.e., 15 years), but not the actual dollar cost.

By this point, you may likely agree with me that the 15 year mortgage is the better option … not just for first time home buyers, but for anyone obtaining a home mortgage. The idea is to strive to get the 15 year mortgage, if you can afford making the higher payments.

Perhaps you have a different take on this. We would welcome other viewpoints or strategies that people share.