About Loanreader

In November 2015, Loanreader launched this website. Our mission is to provide financial tools that give people greater visibility with mortgages, allowing them to make smarter decisions with borrowing money and with paying back the money. Our financial tools are user-friendly and highly versatile as they can be used for various types of loans such as HOME loans, COMMERCIAL loans, AUTO loans, and COLLEGE loans. With our calculators, you can…

| Create Enter Measure Understand Compare |

the amortization schedule for your loan including the date when it started special scenarios (e.g., a 27-year loan, a Balloon loan, an Interest Only loan, or an ARM, with various compound frequencies total cost in the near future, not just at the end of the 15 or 30 year period. your total cost which includes principal, interest, closing costs, points, PMI, taxes and insurance, and extra payments detailed loan scenarios side-by-side, on equal terms, and quickly and easily decide the best option |

Ten reasons why Loanreader calculators are special and unique.

Our calculators…

∑ are user-friendly and versatile

∑ can be used for various types of loans such as HOME loans, COMMERCIAL loans, AUTO loans, and COLLEGE loans

∑ allow you to build the amortization schedule for your specific loan including the date when it started

∑ handle special scenarios such as a 27-year loan, a Balloon loan, an Interest Only loan, or an ARM, with various compound frequencies

∑ include property taxes, home owners insurance, and tax rate for deductions on federal tax

∑ include options for Extra payments and a Biweekly payment program

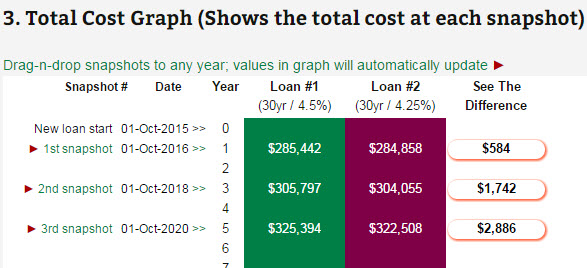

∑ allow you to compare loans side-by-side, on equal terms

∑ show you actual dollar amounts of what you can save if you make extra payments, or if you join a biweekly payment program, or if you refinance.

∑ enable you to see your cost in the middle of the loan period, not just at the end of the loan.

∑ have help buttons throughout the website to help explain the concepts